Bringing Traditional Finance Onchain

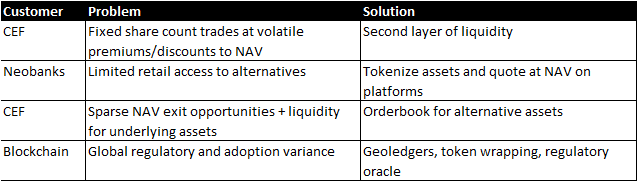

The $22 trillion[7] alternatives market, encompassing assets like real estate, private equity, and infrastructure, is poised for significant growth but faces critical challenges. Fragmented across isolated networks, these investments suffer from limited efficiency, accessibility, and scalability. While tokenization offers potential solutions, integrating liquidity across multiple blockchain networks remains complex and costly. Solving this fragmentation is crucial to unlock the market's full potential, democratize access, and meet growing global capital needs, all while maintaining investor protection.

Closed-End Funds

- Premium/Discount Volatility: Significant price deviations from NAV.

- Inefficient Market: Limited share trading volumes and price impact.

- Limited Arbitrage: Lack of efficient price correction mechanisms.

- Market Access: Limited retail participation.

- Illiquid Holdings: Difficulty valuing and selling underlying fund assets.

- Activist Exploitation: Vulnerability to short-term profit-seeking strategies.

PE MANAGERS/INVESTORS NEED LIQUIDITY

- An absence of exits after record LP commitments has created a massive need for liquidity (unrealized NAV of ~$1.5Tn from funds dated 2010-18).

Click here to see our products.

Traditional Finance

- Inefficiency: High organizational burden in traditional finance

- Limited Access: Large groups underserved by traditional finance

- Opacity: Lack of transparency in traditional financial systems

- Centralized Control: Dominance of central banks and large institutions

- Lack of Interoperability: Difficulty integrating traditional financial products

Blockchain

- Liquidity remains spread at (often) sub-viable levels across different isolated networks, limiting scale effects.

- Connection to (and aggregation of) liquidity across multiple chains is a bespoke effort and therefore acts as a disincentive to scale for participants.

- Differing rates of adoption risk is giving rise to divergent industry operating models (based on traditional vs. digital technologies) for end-investors, such as the need for digital wallets vs. traditional custody accounts.

- Connectivity between traditional securities and digital assets is still being defined on a case-by-case basis and limits scale, especially in the context of the legacy platforms that continue to support core processing today.

- Integration of further relevant process components, such as payment processes on chain, remain unavailable at wholesale grade.

- Variances in regulatory clarity globally drive different speeds of evolution across different assets and parts of the trade cycle (e.g., issuance vs. clearing vs. collateral).

- Due diligence and risk management processes have to be tailored to each blockchain operator, creating an unscalable oversight burden.

- Complexities in governance requirements make many participants reluctant to run their own blockchain nodes, limiting the decentralized nature of the networks.

CEF Puzzle

- NAV miscalculation, transparency

- Agency costs

- Illiquidity of underlying

- Capital gains tax liabilities

XFT issues tradeable tokens representing shares of closed-end fund and allows creation/redemption at NAV. Arbitrage opportunities eliminate discount/premium, aligning market price with NAV.

Updated 8/2/2024

REFERENCES

- Apex Clearing Corporation. (2023). Apex Q2-2023 ANIO Report Final. Retrieved from https://xproblem.replit.app/assets/sources/Apex_Q2-2023_ANIO-Report_final.pdf

- BlackRock. (2023, September). Understanding Closed-End Fund Premiums and Discounts. Retrieved from https://www.blackrock.com/us/individual/literature/investor-education/understanding-closed-end-fund-premiums-and-discounts.pdf

- CAIA Association. (2021). Tokenisation of Alternatives. Retrieved from https://caia.org/sites/default/files/2021-02/CAIA_Tokenisation_of_Alternatives.pdf

- Clearstream, DTCC, & Euroclear. (2023, September). Advancing the Digital Asset Era, Together [Industry Paper]. Retrieved from https://www.clearstream.com/resource/blob/3815754/3316ec2b8cf3e9cdb93a5e58fd5c76c6/dtcc-digital-asset-paper-data.pdf

- Edwards, A. K., Harris, L. E., & Piwowar, M. S. (2007). Corporate Bond Market Transaction Costs and Transparency. The Journal of Finance, 62(3), 1421-1451. Wiley for the American Finance Association. Retrieved from https://www.jstor.org/stable/4622305

- Fidelity Investments. (2012). CEF Discounts and Premiums - Fidelity. Retrieved from https://www.fidelity.com/learning-center/investment-products/closed-end-funds/discounts-and-premiums

- Filbeck, A. (2024, January). The Next $20 Trillion in Alternative Investments. Chartered Alternative Investment Analyst (CAIA) Association. Retrieved from https://caia.org/content/january-2024-next-20-trillion-alternative-investments

- HQLAx. (2023, June 15). Expanding HQLAᵡ's digital registry value proposition for collateral mobilisation. Retrieved from https://www.hqla-x.com/post/expanding-hqla-s-digital-registry-value-proposition-for-collateral-mobilisation

- Institute of International Finance. (2024, May). CEF Activism. Retrieved from https://www.ici.org/system/files/2024-05/cef-activism.pdf

- Mayer Brown. (2022, May). Business Development Company Guide for Capital Markets. Retrieved from https://www.mayerbrown.com/-/media/files/perspectives-events/publications/2022/05/business-development-company-guide-for-capital-markets.pdf

- McPartland, K., & Kolchin, K. (2023, May 9). Understanding Fixed Income Markets in 2023. SIFMA Insights. Retrieved from https://www.sifma.org/resources/research/understanding-fixed-income-markets-in-2023/

- Nuveen. (2024). What to Know About Buying Closed-End Funds at a Discount. Retrieved from https://www.nuveen.com/en-us/insights/closed-end-funds/what-to-know-about-buying-closed-end-funds-at-a-discount

- Robert W. Baird & Co. (2023). Closed-End Funds and Unit Investment Trusts. Retrieved from https://www.bairdwealth.com/globalassets/pdfs/help/closed-end-funds-and-uit.pdf

- Saba Capital Management, L.P. (2024, May 5). What's Happening: Insights & Inspiration from BlackRock [Blog]. Retrieved from https://www.heyblackrock.com/whats-happening

- Schultz, P. (2001). Corporate Bond Trading Costs: A Peek behind the Curtain. The Journal of Finance, 56(2), 677-698. Wiley for the American Finance Association. Retrieved from https://www.jstor.org/stable/222578

- The Scott Letter. (2008, October). Scott Letter: Closed-End Fund Report. Retrieved from https://cefadvisors.com/ScottLetter/2008/2008-10.pdf

- Wessel, D. (2021, August). DeFi and the Future of Finance - Duke University. Retrieved from https://compoundmaven.com/wp-content/uploads/2022/08/DeFi-And-The-Future-Of-Finance-Duke-University-August-2021.pdf